snohomish property tax rate

Snohomish WA 98291-1589 Utility Payments PO. If the property is outside the shaded area it is in unincorporated Snohomish County not in city limits.

Graduated Real Estate Tax Reet For Snohomish County

Motor vehicles sales or leases Effective April 1 2022.

. While the exact property tax rate you will pay for your properties is set by the. Quarter 2 2022 Motor vehicle rate change notices. Cook County collects on average 138 of a propertys assessed fair market value as property tax.

To qualify the data center must have a building permit to construct renovate or expand the data center issued after June 9 2022 or refurbish an existing facility. This tax officially called the real estate excise tax REET is equal to a specific percentage of the price of the home being sold and it is typically paid by the seller. The median property tax in Cook County Illinois is 3681 per year for a home worth the median value of 265800.

Franklin County Mental Health Tax Car Dealers and Leasing Companies. The tax break can exempt developers from property taxes on housing projects for eight years. Snohomish County Treasurer 3000 Rockefeller Avenue MS 501 Everett WA 98201.

Box 1589 Snohomish WA 98291-1589 Report a Problem after-hours 360 563-2012 Non-police related Phone. Supplemental Secured Property Tax Bill. Lodging tax rate information.

Snohomish County Housing and Related Services. To reach Snohomish County call 425-388-3411. Snohomish County Government 3000 Rockefeller Avenue Everett WA.

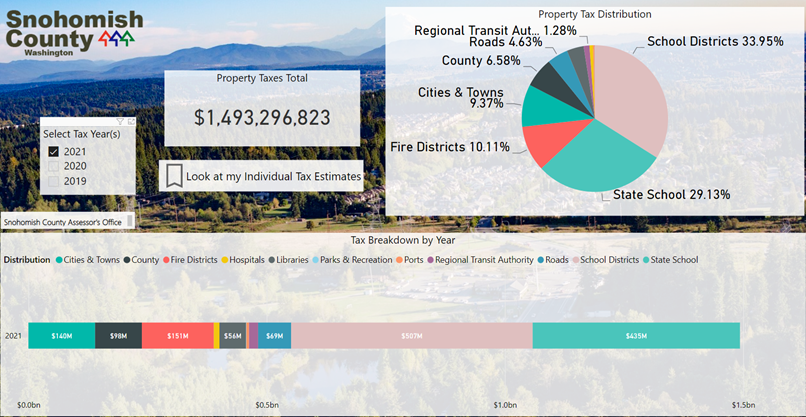

Motor vehicle tax rates. For purposes of the reduced BO tax. The assessed value of your property is multiplied by the tax rate necessary in your levy area to produce your fair share of the total levied tax by these jurisdictions.

Your actual property tax burden will depend on the details and features of each individual property. Cook County has one of the highest median property taxes in the United States and is ranked 91st of the 3143 counties in order of median property taxes. If you received an envelope with your tax statement please use the pre-printed envelope.

1400 units divided by 102 acres yields. Quarter 2 2022 Lodging rate change notices. The Treasurer calculates the taxes due and sends out the tax notices using the taxing district information.

Pierce or Snohomish County. Cities also have the option to levy an additional 025 tax on property sales. The rate or value of a property for taxation purposes.

Yet his own Midtown ordinance requires a minimum of 16 units per acre. If at least 20 of the homes are set aside for low- to moderate-income tenants the break can last 12. Assessors Identification Number AIN A 10-digit number aka map book page and parcel that identifies each piece of real property for property tax purposes eg 1234-567-890.

Pickus claims that the Midtown area cant accommodate 1400 new dwelling units. Mailed payments must be postmarked by the tax due date or they will be returned for interest and penalties. 1 2020 Washington revamped the rate structure for its REET tax.

To determine whether a property is within Snohomish City limits enter the address into the search field below. A person must pay the tax and may then take a credit equal to the property tax paid.

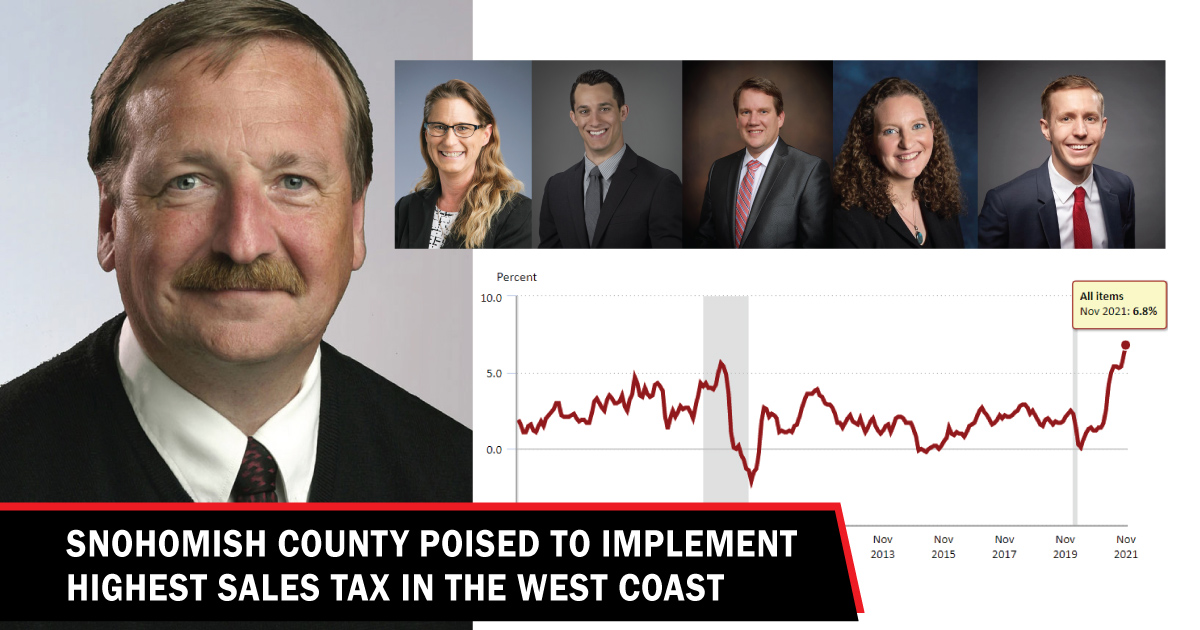

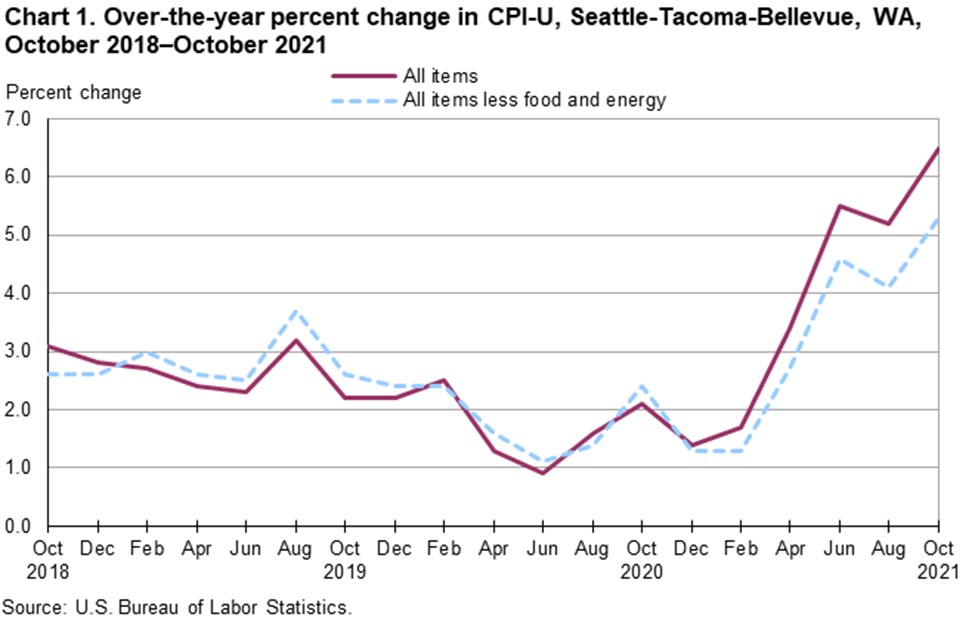

County Poised To Pass 0 1 Sales Tax As Inflation Hits 40 Year High Lynnwood Times

Snohomish County Home Values Soar In Latest Assessment Heraldnet Com

Graduated Real Estate Tax Reet For Snohomish County

Snohomish Weighs Tax Breaks For Affordable Homes Though Results Vary Heraldnet Com

How To Read Your Property Tax Statement Snohomish County Wa Official Website

County Poised To Pass 0 1 Sales Tax As Inflation Hits 40 Year High Lynnwood Times

Everett And Snohomish County News From The Herald Heraldnet Com

County Poised To Pass 0 1 Sales Tax As Inflation Hits 40 Year High Lynnwood Times

County Poised To Pass 0 1 Sales Tax As Inflation Hits 40 Year High Lynnwood Times

Property Taxes And Assessments Snohomish County Wa Official Website

News Flash Snohomish County Wa Civicengage

How To Read Your Property Tax Statement Snohomish County Wa Official Website

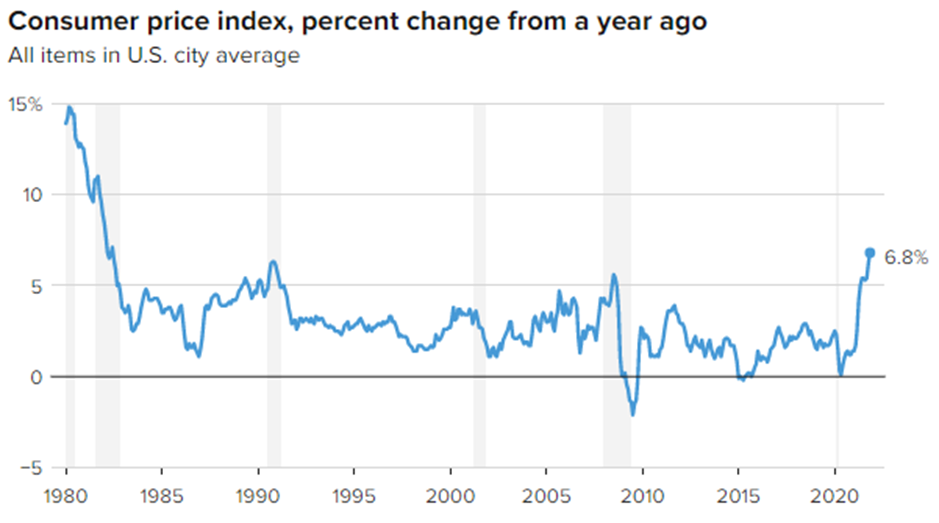

Property Taxes Rise For Most Of Snohomish County In 2020 Heraldnet Com

Property Taxes Rise For Most Of Snohomish County In 2020 Heraldnet Com